Black voters surveyed by theGrio/KFF want Biden to address inflation–only 12% named student debt as top economic issue

A new study shows that Black voters want President Joe Biden and Congress to tackle the issue of inflation and The post Black voters surveyed by theGrio/KFF want Biden to address inflation–only 12% named student debt as top economic issue appeared first on TheGrio.

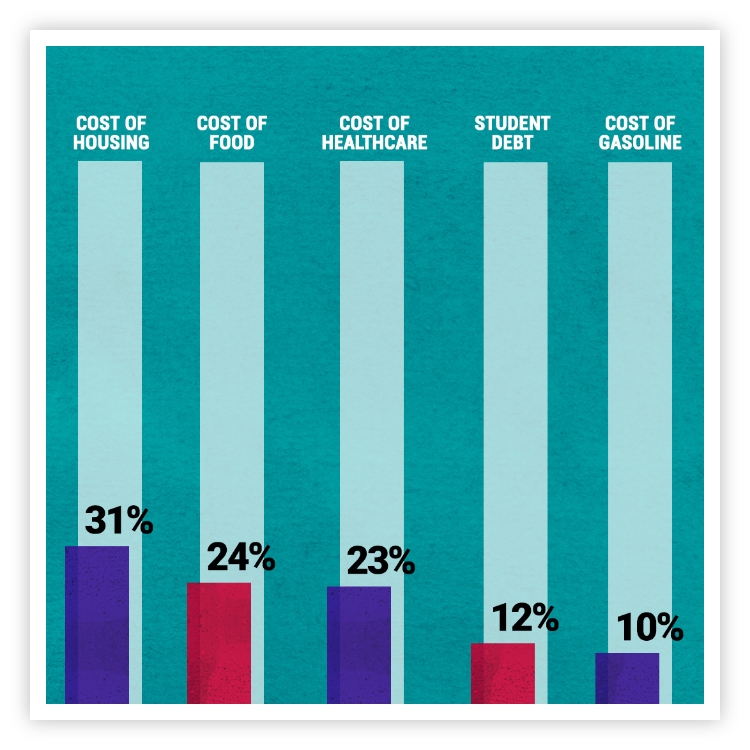

A recent theGrio/KFF Survey found that when asked which economic issue they most want Biden and Congress to address, most Black voters chose the rising cost of housing (31%), food (24%) and healthcare (23%).

A new study shows that Black voters want President Joe Biden and Congress to tackle the issue of inflation and its impact on the Black community.

A recent theGrio/KFF Survey found that when asked which economic issue they most want Biden and Congress to address, most Black voters chose the rising cost of housing (31%), food (24%) and healthcare (23%). Housing is the top economic concern for Black voters who are women, fall within the 18-49 demographic and who earned a yearly salary of $40,000 or less.

Thinking about the economic problems facing U.S. consumers, which of the following do you MOST want President Biden and Congress to address?

Allan Boomer, a managing partner at Momentum Advisors, one of the largest Black-owned wealth management firms in the U.S., told theGrio that “Most Americans live on a set paycheck. The cost of living on things that are important like food or gasoline is going to have a direct economic impact.”

He continued, “[The Black] community probably spends a greater percentage than other groups on these essential items just based on the fact of the income gap and if everybody is paying the same rent but I make less money it’s that much more critical for me.”

Boomer added that because Black Americans have to spend more money “at the pump” or on rent, this “exacerbates” the racial wealth gap.

“Money that might have otherwise gone towards saving and investment now needs to go towards the same food that I bought last month that has now increased in price or the same gallon of gas that I bought a year ago which has also increased in price,” he explained.

Earlier this month, the Biden-Harris administration unveiled a plan to tackle the racial wealth gap; however, Boomer said although it is a step in the right direction, the administration should go further to help Black Americans, especially at a time when the nation is experiencing stubborn inflation.

“There is not one way to close [the wealth gap]. It won’t close overnight…I think everything in the plan is solid, I just think that it doesn’t go far enough,” he said.

Apart from the negative impacts of inflation, theGrio/KFF survey found that only 12% of Black voters choose student debt as the top economic issue that they would like to see addressed by President Biden. TheGrio/KFF Survey of Black Voters started being conducted the same day the Biden administration announced its student debt relief program on Aug. 24 and concluded on Sept. 5.

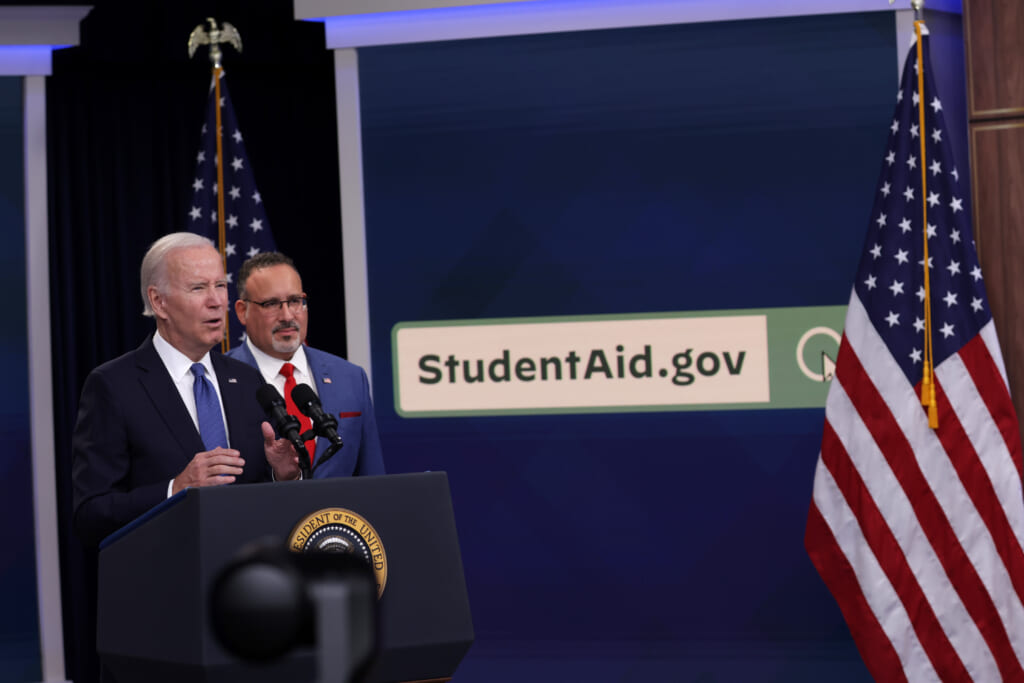

This could be due, in part, to the president recently rolling out his student debt relief program for those earning less than $125,000 a year. On Monday, he officially launched the application, which will potentially provide a solution for easing economic pains for borrowers, who could see up to $20,000 in student debt relief as early as Oct. 23.

Democratic strategist Ameshia Cross told theGrio that she sees student debt as a top economic issue, especially for Black Americans. She said she would have liked to see the Biden-Harris administration eliminate $50,000 in student debt, but believes Biden’s student debt relief program is off to a good start.

“One of the things that I pushed back against the administration on is the requirement for there to be an application,” Cross said.

She added that she fears, “That some of the people who need the most help and the most assistance will not be able to access” the application or, even worse, receive student debt relief because they may lack the resources to complete the form.

While some Black voters who participated in the survey may not have any student loan debt, Cross says others who do, may not have placed the issue at the top of their list because the Biden-Harris Administration paused loan payments through Dec. 31, 2022.

“A lot of individuals quite frankly, did not pay student loans and have not paid student loans in a while since the pandemic created those causes and the administration signed on to that,” Cross explained.

She added, “I think that those same people should you poll them in January once having to pay their student loan debt kicks back in, they might have a different viewpoint” on what they believe Biden and Congress should tackle.

Victoria Jackson, the author and lead researcher for the “National Black Student Debt Study” told theGrio, that Black Americans borrow more student aid than any other race, greatly impacting their financial and mental health. Jackson said the racial wealth gap is to blame and has been caused by “racist policies” and practices that have been implemented in the U.S. for centuries.

“The racial wealth gap is reflective of the accumulated effects of slavery, Jim Crow, redlining, discrimination in lending and discrimination in employment, which leaves Black borrowers with significantly less wealth to be able to do things like a afford to go to college in the first place, but also than the ability to repay their loans,” she said.

As a result, Jackson says, “You can really see the toll that it takes on people particularly when they get into situations of being in a delinquent” or default status.

Cross speculated that there may be a disconnect where Black voters cannot tie “student loan debt with its real-world consequences.”

She added, “Student loan debt [forces] people to put off things like buying a home, things like buying a car, things like moving out of their parent’s homes.”

Cross said this is especially true for Black women who are “saddled” with student debt and are usually in positions where they make less than “any other demographic in this country,” despite their skillset or the number of degrees they have acquired.

“Two-thirds of the $1.7 trillion in student loan debt that is held in this country, currently two-thirds of that is held by Black women. That is huge. It is the largest expenditure on housing for Black women. It is singularly something that is keeping this population back,” she explained.

Boomer told theGrio that the racial wealth gap continues to increase due to barriers that prevent Black Americans from owning homes and attaining assets, like the increase in the cost of living and the student debt crisis.

“It’s the fact that for decades it was redlining that not only restricted our access to certain neighborhoods, it also greatly reduced and eliminated our ability to obtain mortgages,” he said.

He added, for some, student loan debt and inflation is a hindrance to obtaining parts of “the American dream.”

About the Survey

The Survey of Black Voters is the first partnership survey between theGrio and KFF, a nonprofit organization focused on research and analysis of health and other national issues. Teams from KFF and theGrio worked together to develop the questionnaire and analyze the data, and both organizations contributed financing for the survey. Each organization is solely responsible for its content.

The survey was conducted Aug. 24–Sept. 5 with a nationally representative, probability-based sample of 1,000 adults who identify as Black or African American and are registered to vote. The sample includes all voters who identify as Black or African American, including those who also identify as Hispanic or multi-racial. The sampling design includes Black registered voters reached online through the SSRS Opinion Panel and the Ipsos KnowledgePanel; to reach Black voters who do not use the internet, additional interviews were conducted by calling back respondents who previously participated in an SSRS Omnibus poll and identified as Black and said they did not use the internet. The combined telephone and panel samples were weighted to match the sample’s demographics to the national U.S. population of Black voters using data from the Census Bureau’s 2020 Current Population Survey (CPS) Voting and Registration supplement. Sampling, data collection, weighting and tabulation were managed by SSRS of Glen Mills, Pennsylvania, in close collaboration with KFF researchers.

The results have a margin of sampling error of plus or minus 4 percentage points for results based on the full sample of Black voters. The full methodology and question-wording are available here.

TheGrio is FREE on your TV via Apple TV, Amazon Fire, Roku and Android TV. Also, please download theGrio mobile apps today!

The post Black voters surveyed by theGrio/KFF want Biden to address inflation–only 12% named student debt as top economic issue appeared first on TheGrio.